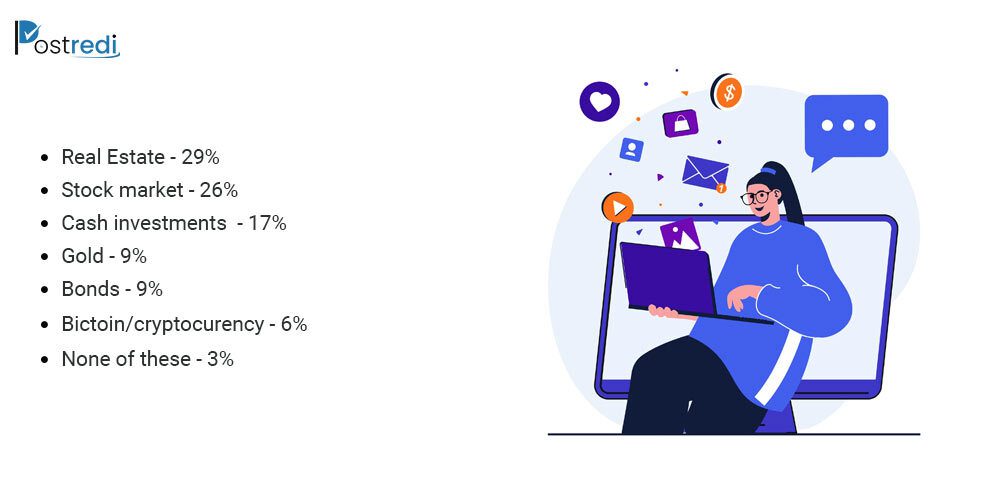

It’s no hidden knowledge that the best way to grow wealth for a long period is through investments. Real estate the best investment, with its runner-up stocks, remains one of the top picks for investing money. Despite the inflation surges and forecasts of recession, real estate remains a favorite long-term investment for a lot of people.

Real Estate – Best Investment Jobs

So, is real estate the best investment jobs option in 2022? We have compiled a list of reasons to answer your question.

Real Estate Investments Offer Portfolio Diversification

An investor’s priority is to bring diversification to their portfolio. One reason is to build a good profile. Another more important reason is to hedge against any risks. In real estate, you get a lot of options in both active and passive investing. So, instead of just investing in different stocks, try investing in other asset classes like real estate.

Real estate and the stock market move independently – the correlation between other asset classes and real estate is almost negative. Consequently, you have more chances to protect your wealth. In case of any major turndown, the net worth of your investment won’t plummet.

Suitable for Long-term Investment

The most popular and reliable long-term investment is real estate, especially among Americans.

Once you add real estate to your investment plan, you get long-term security for your wealth and a decent monthly income. Additionally, there are many ways of earning passive income through real estate. Over the long haul, you get to earn significant wealth.

The Rise in Home Values

The year 2021 saw a significant boom in house prices over the last two decades. Over the last 10 years, U.S home prices increased up to 48 percent. Real estate is still going strong and has an advantage over stocks due to its volatility. So you can expect higher returns in the case of real estate investments.

However, every investment comes with a risk and real estate is not free from it either. The market faces some ebbs and flows now and then. But home values mostly tend to rise over time. Moreover, the interest rates this year were also low, which is one of the reasons why real estate will be the best investment option in 2022.

Related Posts – Real Estate Housing Market success in 2023

There is Always Demand for Rentals

Rentals are always in demand and they allow you to build equity. Single-family rentals usually appreciate in value and offer higher returns. Short-term rentals, especially vacation homes generate higher profits. They are a top priority for travelers. But there is also a higher turnover probability and vacancy rate. If you achieve 100 percent occupancy, you might end up making $5,735 rental income on average per month.

–> How To Make Social Media Strategy For Short-Term Rental Businesses

There are already plenty of candidates for your property. Through social media engagement, you can interact with potential leads and find a suitable tenant for your property. Want your social media posts to be generated and scheduled ahead of time? Use Postredi – a social media scheduler designed to help you maintain an optimized social media presence and connect with every lead.

Maintain a Regular Cash Flow – Attain Financial Security

Cash flow refers to the net income you get out of a real estate investment after deducting the operational costs and mortgage payments. This cash flow only strengthens with time as you slowly build your equity and pay down the mortgage. In addition to increasing your overall savings, the monthly cash flow will help you with bills and debts.

People feel more financially secure when they invest their money in a profitable investment. Housing tends to bounce back which is why there is a keen sense of financial security attached to it. After retirement, you can sell this property with a huge profit. Having such long-term financial advantages makes real estate the best investment option.

So Many Opportunities for Investment

When people hear the word “real estate”, their minds quickly start to picture the hectic life of a landlord – open house invites, management of tenets, keeping up with the renovations, and so on. However, you can invest in real estate without owning a property too. From REITs to mutual funds, you can put your money in any passive real estate investment.

Inflation Hedging Capability

Real estate has a good inflation hedging capability in the long run because of a positive relationship between real estate demand and GDP growth. As the economy expands, we see a surge in rents, especially for commercial property.

Some of this inflationary pressure gets shifted to tenants while the rest gets incorporated into capital appreciation. With a fixed mortgage rate, you will gain a significant profit margin.

Tax Benefits

Tax deductions and breaks are the crucial reasons why real estate is the best investment option. With the help of skilled realtor, you can save money by taking advantage of tax deductions. In the case of rentals, the tax deductions include:

- Payments of mortgage interests.

- Any property maintenance – is ongoing.

- Property taxes and insurance.

You might also be able to use the 1031 exchange (exchange of one real estate property with another similar one) to defer capital gains. Unlike other asset swaps, it has minimum tax liabilities.

More Appreciation

You can increase real estate appreciation on your own too. With just yearly house staging, real estate appreciates around 3-5 percent. But through renovations, you can increase this average appreciation. Even a few minor renovations like improving kitchen space, increasing storage space, finishing the basement, etc can generate 8090 percent returns on your invested money.

A pro tip here is to work with a licensed real estate agent to make renovations that will increase the home’s value.

So, What About Stocks?

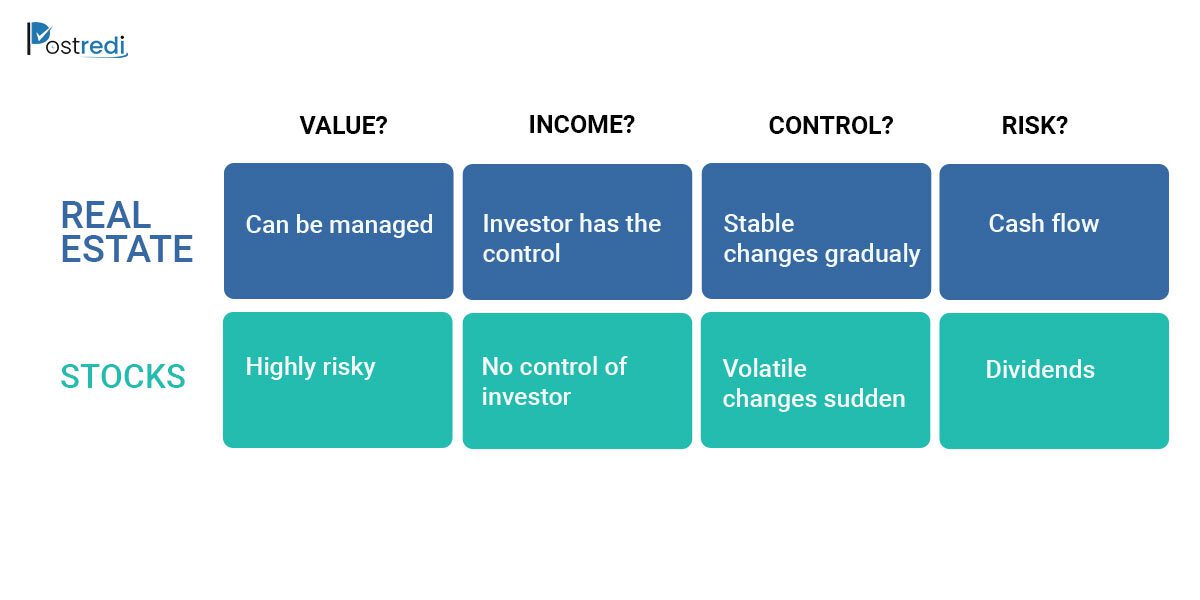

Stocks are a great option for investment too as they increase both cash dividends and profits over time. They also allow portfolio diversification. You get to invest in multiple companies and spread out your real estate investment capital. The annual returns can sometimes be higher than the annual inflation rate. Certain setbacks, however, can turn it into a bad investment.

The most basic dilemma that an investor would face is the volatility of the market. Stocks are highly unpredictable and can fluctuate dramatically within a short period of time. This can be quite frustrating for an investor. Real estate, on the other hand, is a much more stable investment, as there is less risk involved. Stocks offer lesser control. You might find yourself consulting with a financial advisor or a stockbroker from time to time. Real estate, on the other hand, offers much more control and continues to grow. When it comes to ROI, real estate offers great potential for generating income as compared to stocks.

So what is the best investment option in 2022? Well, from the above options we can deduce that real estate is a much better option as compared to stocks or bonds. The industry can withstand high inflation, difficult financial situations, and other risks.

Bottom Line

Over the years, real estate has proven itself to be the best investment option for both short-term and long-term investments. An investor’s portfolio is a direct representation of their financial objectives and personality. And real estate business offers a huge potential market for this purpose. The above guide was compiled to help you make a well-informed investment decision.